N72 AI Economy Inflection - Foundation Edition - Personal Licence

Semiconductor investment decisions are hard when engineering reality and financial models don’t connect.

THE AI ECONOMY INFLECTION — FOUNDATION EDITION

Independent Semiconductor Equity Research

Structural analysis through 2035

PERSONAL LICENCE — €6,450 (Price excludes VAT)

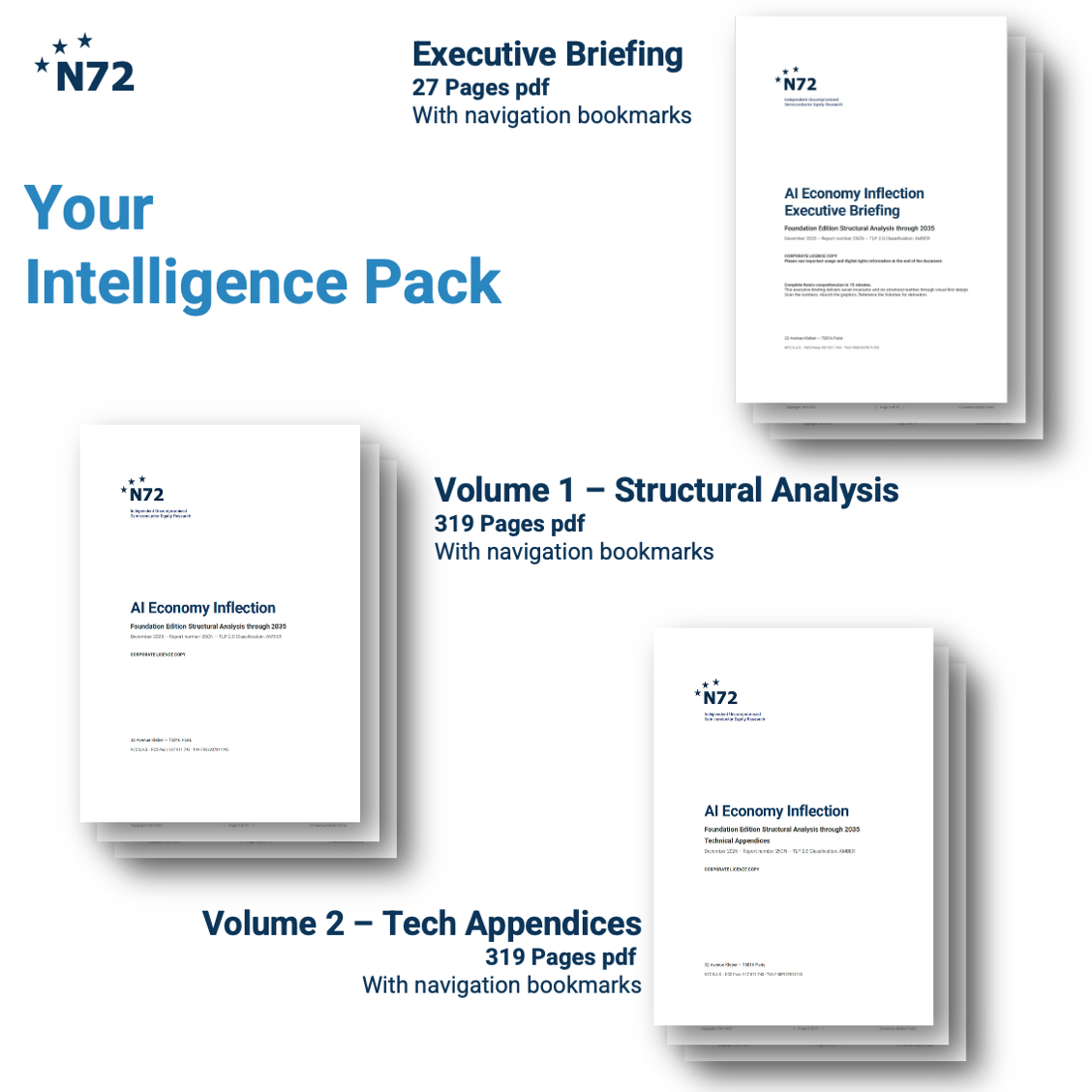

What You Receive:

✓ Executive Briefing (27 pages, PDF)

✓ Volume 1: Strategic Analysis (319 pages, PDF)

✓ Volume 2: Quantitative Framework (118 pages, PDF)

✓ 30-Minute Insight Bridge Call with the Analyst

✓ All PDFs include navigation bookmarks

WHY THIS RESEARCH EXIST?

Hyperscalers report facility-level depreciation that diverges from component-level engineering reality. The gap compounds across the industry. The report quantifies it.

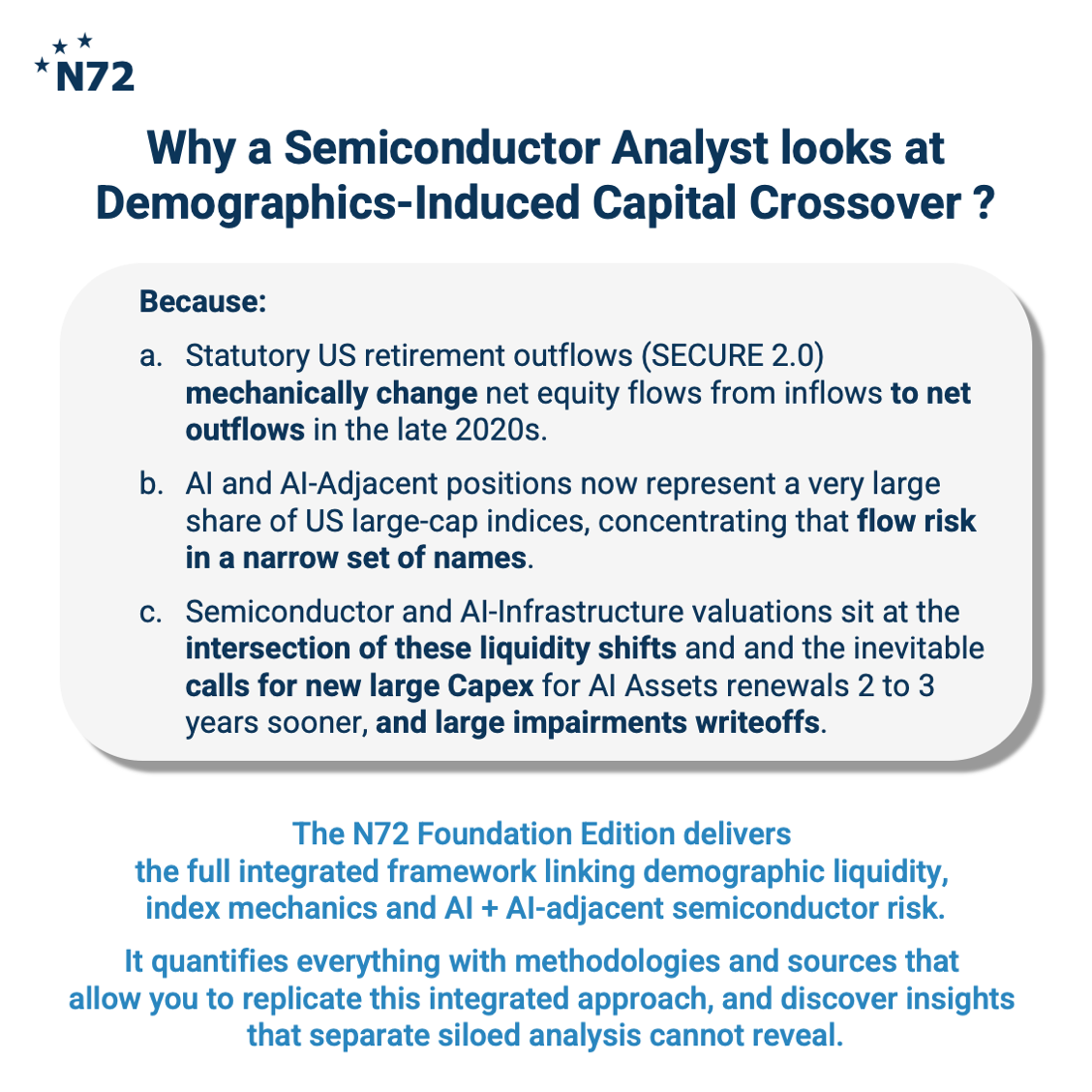

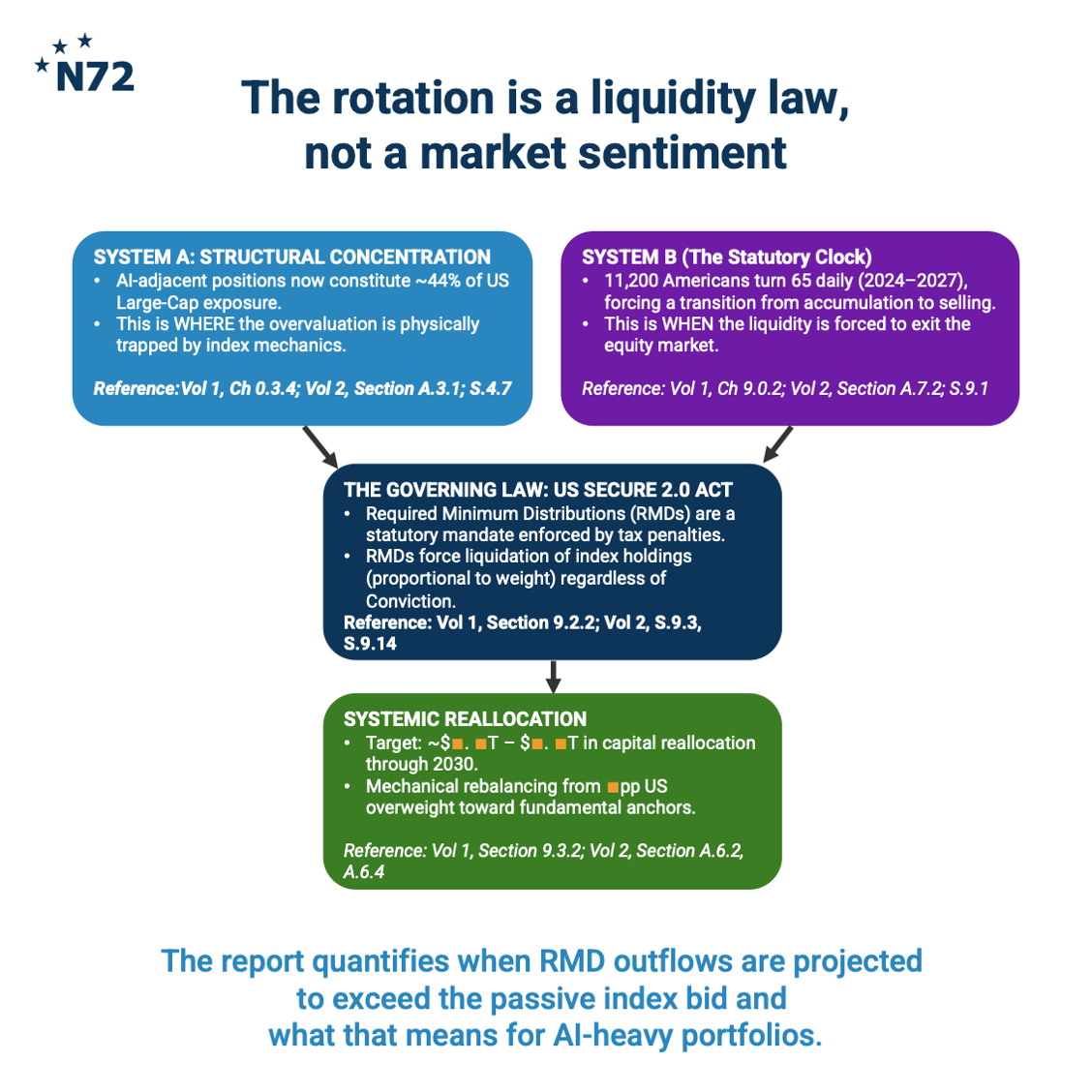

At the same time, statutory US retirement outflows and index concentration are reshaping liquidity in markets where AI platforms and AI‑dependent semiconductor names now carry significant weight.

This Foundation Edition presents the full integrated framework. It quantifies these forces and maps how they interact.

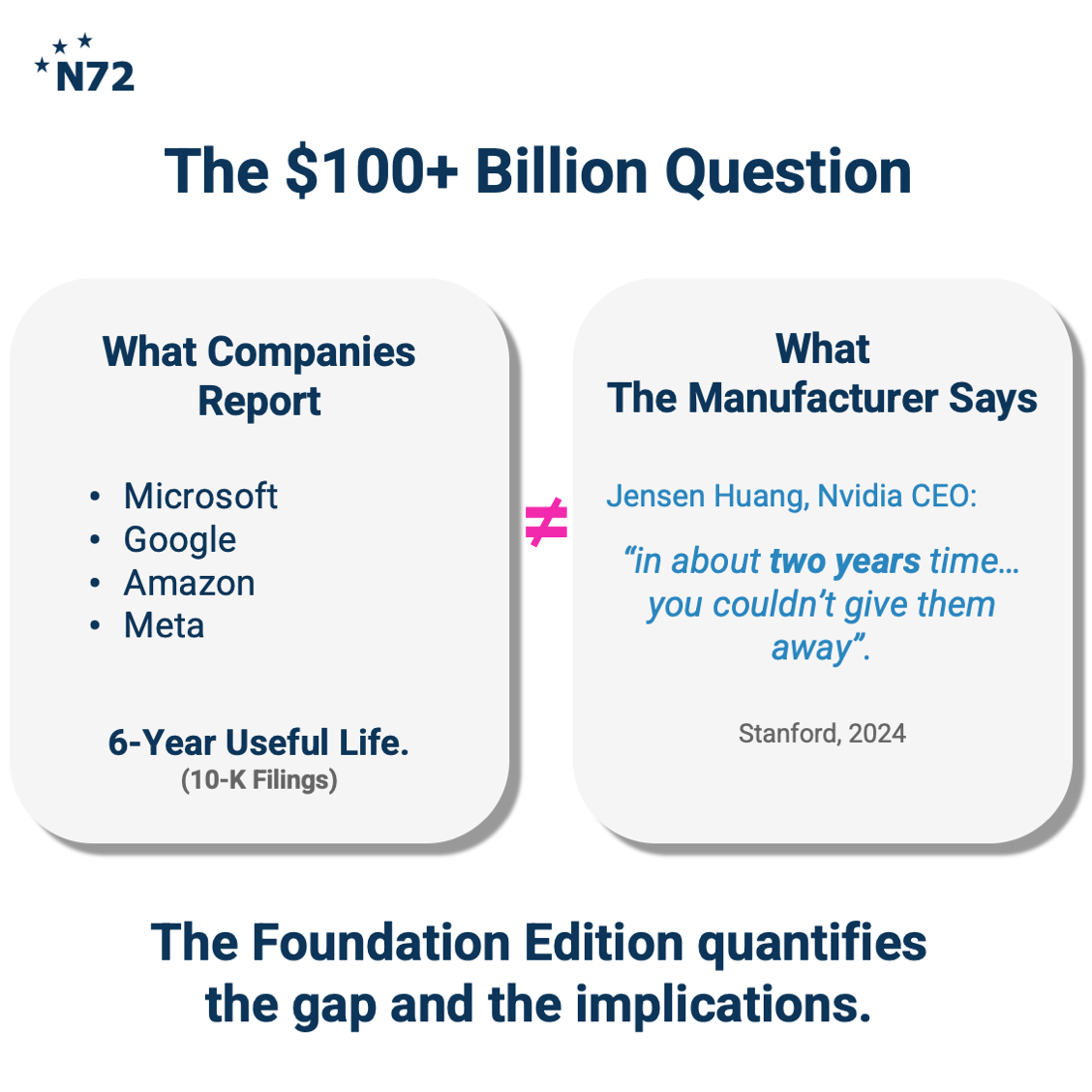

THE CONTRADICTION THAT STARTED THIS RESEARCH

What Companies Report (10-K Filings):

• Microsoft: 5–6 year useful life for server equipment

• Google: 6 year useful life

• Amazon: 5–6 year useful life

• Meta: 5.5 year useful life

What The Manufacturer Says:

Jensen Huang, NVIDIA CEO, Stanford University, March 2024:

"In about two years' time... you couldn't give them away."

Same hardware. Two economic timelines.

The Foundation Edition recalculates the component‑level blended economic life and documents the financial implications at scale.

THE DEMOGRAPHIC TRIGGER

The SECURE 2.0 Act in the US created a statutory timetable for capital rotation. Required Minimum Distributions (RMDs) force retirement account holders to sell equity holdings — regardless of market sentiment or AI narrative conviction.

This is not a prediction. It is law.

The report documents:

• When mandatory outflows are projected to exceed passive inflows

• Why AI-adjacent positions bear concentrated exposure

• How index mechanics trap overvaluation until flows reverse

• The rotation pathway from structural fragility toward fundamental anchoring

WHAT THE FRAMEWORK DELIVERS

The Balance of Forces Methodology

A systematic way to map market structure through quantified forces — from demographic liquidity and index mechanics to AI infrastructure economics.

The Double Ceiling Analysis

How physics (semiconductor reliability under AI workloads) and economics (vendor upgrade cycles) independently constrain hardware useful life — and what that means for reported earnings.

The Operator Stratification Model

A framework for categorising AI infrastructure operators by their structural position — from integrated platforms to pure‑play infrastructure providers — with very different capital efficiency profiles.

The Impairment Phasing Model

A timeline for when the gap between accounting book values and economic reality is projected to surface in financial statements.

REPLICABLE METHODOLOGY — "CHECK MY WORK" RESEARCH

This is not opinion. This is arithmetic.

Every quantitative figure is:

✓ Sourced to verifiable public data

✓ Cross‑referenced to methodology sections

✓ Accompanied by sensitivity analysis

✓ Documented for independent replication

You are not paying for conclusions.

You are paying for methodology and insight.

Sources include SEC filings, semiconductor physics literature, US Census demographic projections, SECURE 2.0 statutory requirements, and central bank financial stability reports.

EARNINGS QUALITY FRAMEWORK

The analysis applies institutional earnings quality methodology as documented in Doron Nissim's Columbia Business School work:

• Accrual quality assessment

• Earnings persistence analysis

• Matching principle evaluation

• Cash conversion verification

This framework allows systematic evaluation of reported earnings durability across AI infrastructure operators.

YOUR 30-MINUTE INSIGHT BRIDGE CALL

Your licence includes a complimentary 30-minute call with Nicolas Chantier, the analyst behind the framework.

Use this session to:

• Clarify methodology and calculation approaches

• Discuss framework applications to your analysis

• Ask technical questions about the models

• Explore areas for deeper investigation

We recommend sending your questions 48 hours in advance to maximise the value of your session.

Note: The call provides research discussion, not personalised investment advice. N72 is not registered as an investment advisor.

MEET THE ANALYST

Nicolas Chantier

Founder, N72 S.A.S.

• 26 years semiconductor industry experience

• Columbia Business School

• EM Lyon Certified Board Director

N72 is a member of Finance Innovation.

Regulatory guidance provided by Regulation Partners.

WHO SHOULD READ THIS

This report is for professionals who:

- Need to stress‑test AI‑adjacent portfolio exposure

- Evaluate passive fund and index concentration risk

- Review depreciation governance for audit and risk committees

- Build structural scenarios for AI infrastructure and semiconductors

- Require documented, replicable methodology for fiduciary defense

If your decisions depend on how AI infrastructure economics, demographics, and index mechanics interact, this framework provides the map.

WHAT'S INCLUDED — PERSONAL LICENCE

✓ Executive Briefing — 27 pages

Complete thesis comprehension in approximately 15 minutes.

Visual-first design with navigation bookmarks.

✓ Volume 1: Strategic Analysis — 319 pages

Full logical framework from demographics to deployment cycles.

Cross-referenced to all figures and calculations.

✓ Volume 2: Quantitative Framework — 118 pages

Complete methodology documentation.

Calculation templates for independent replication.

Comprehensive glossary of 130+ terms.

✓ 30-Minute Insight Bridge Call

Direct session with the analyst via Google Meet.

Book directly in Nicolas's calendar after purchase.

Personal Licence grants usage rights for one individual only.

Need to share within your organisation?

Purchase the Corporate Licence for multi-seat rights and

the Visual Implementation Deck with speaker notes.

EARLY PURCHASER BENEFITS

Foundation Edition buyers will receive:

• Priority notification for Extended Edition release (Q1 2026)

• Eligibility for early-bird discount on Extended Edition

• Eligibility for preferential rates on future subscription plans

ABOUT N72

N72 S.A.S. is a Paris-based independent research institution.

• Family-owned — no banking conflicts or sell-side pressures

• Member of Finance Innovation

• Regulatory guidance by Regulation Partners

This report constitutes market structure research.

It is not investment advice.

N72 is not registered with the AMF as an investment advisor.

N72 S.A.S.

32 Avenue Kléber, 75016 Paris, France

RCS Paris 937 811 743

A NOTE FROM THE ANALYST

I built this framework after 26 years in semiconductors because the same question kept returning: what happens when engineering reality and accounting policy finally meet?

The goal isn’t to replace existing research. It’s to add something that wasn’t available before: deep semiconductor domain knowledge formalised into auditable, replicable methodology.

If you read the report and see things differently, I would genuinely welcome that conversation. That is often where the most useful insights emerge.

— Nicolas Chantier, Founder, N72 S.A.S.

DELIVERY

Upon purchase, you will receive:

1. Immediate download links for all PDF documents

2. Welcome Letter with content navigation guide

3. Link to book your Insight Bridge Call

Questions before purchasing?

Contact: nicolas.chantier @ n72.tech